There comes a time in life when the weddings of our friends and family members seem to dominate our calendars and our budgets. We take celebrating the milestones of our friends and family seriously, but this is a tremendous expense, one that we could see increase as weddings postponed by the pandemic finally take place.

According to the most recent numbers from the Wedding Report, experts predict historic nuptial numbers for 2022. An estimated 2.5 million Americans plan to tie the knot this year — the most since 1984.

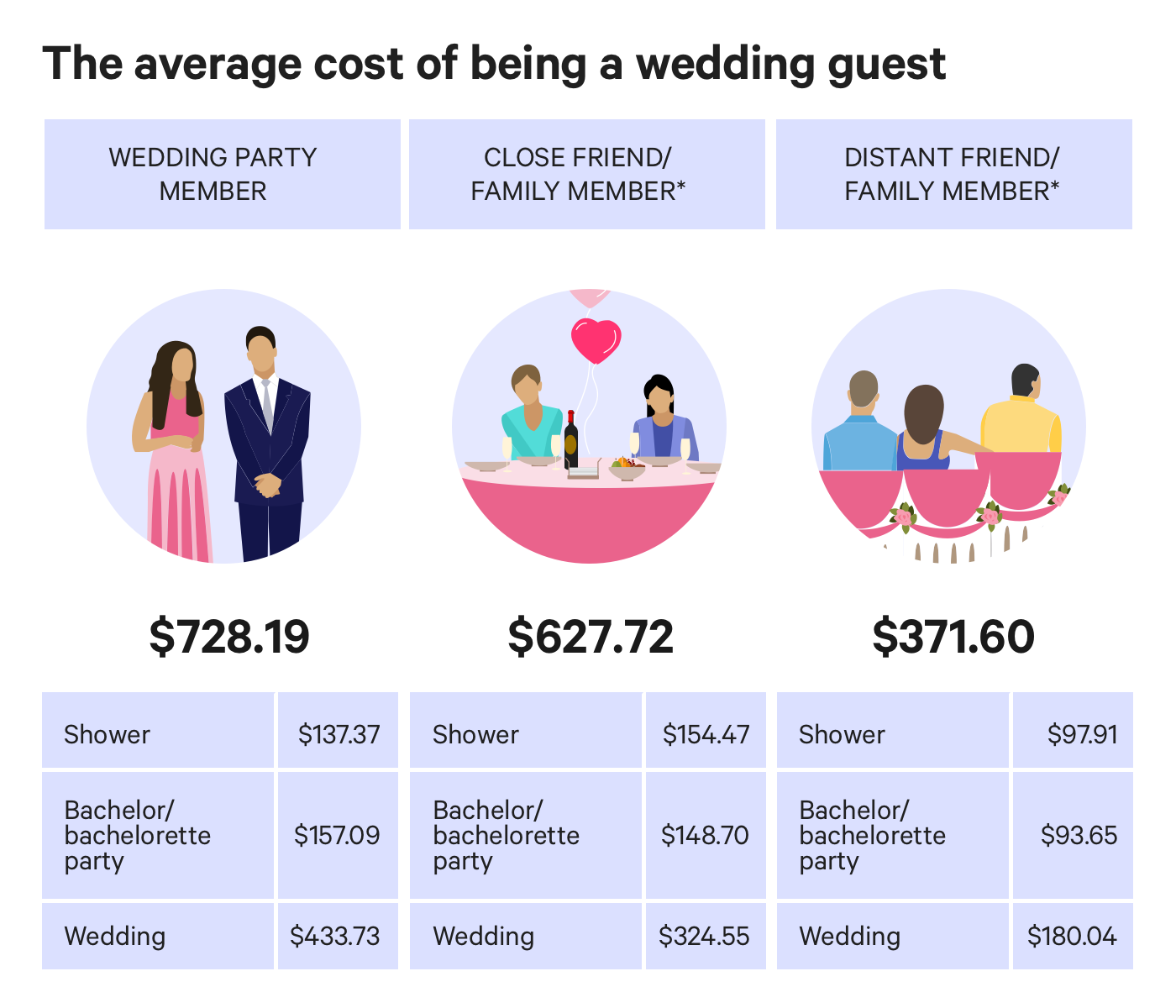

And the financial burden doesn’t fall solely on those saying “I do.” A 2018 Bankrate survey found the average cost of attending a close friend’s or family member’s wedding was $627. For distant friends and family, that number dropped to $370 — still a significant expense.

Here are some tips on navigating wedding season without putting yourself in debt.

Wedding guest meaning and history

As a wedding guest, you’re invited to witness and share in one of the most special moments in your friend or loved one’s life. However, your involvement and financial responsibility might vary depending on if you’re a casual acquaintance, close friend, family member or part of the wedding party.

While the reason for the big day has remained the same, the cost of hosting and attending a wedding has changed drastically over time. Wedding gifts, for example, have increased in cost. While some held the belief that a reasonable amount to spend on a gift was equal to the cost of your plate, that cost now starts around $150, and may increase depending on your personal relationship with the couple getting married.

The pressure to overspend can be daunting for invited guests. Especially if they aren’t accounting for it in their budget. Younger adults are feeling the pain most: 28 percent of Gen Z and 23 percent of millennials feel pressured to overspend on an event this year. Conversely, only 5 percent of boomers feel this way.

Typical costs for wedding guests

The amount you spend to attend a friend or loved one’s wedding will range depending on how well you know the couple getting married, how many pre-wedding events you attend, if the wedding is local or requires you to go out of town, and more. Here’s a look at average costs for a few common spending categories for wedding guests:

| CATEGORY | AVERAGE COST |

|---|---|

| Hair and Makeup | $150 – $600 |

| Travel and Lodging | $660 – $1,270 |

| Attire | $95 – $160 |

| Wedding Gift | $100 – $150 |

And here’s how those costs add up and vary, depending on your relationship with the hosts:

Wedding guest etiquette

Part of what makes a couple’s wedding day so special is having their guests be prompt, present and as eager to share in their special event as they are. That begins even before the big day arrives. A few ways to help make sure the event goes smoothly:

- RSVP on time: Having an accurate headcount is key for the hosts to plan their seating chart. Once you receive your RSVP in the mail, try to respond promptly with an accurate count of how many will attend.

- Only RSVP for those who were invited: If your invite doesn’t include a plus one, you should plan on attending solo. Don’t RSVP for someone who wasn’t originally invited.

- Purchase a wedding gift: If there is a wedding website or registry listed on the invitation, take time to carefully review it in advance. That way you’ll have a wider range of gift options to choose from and you won’t risk showing up empty-handed to the event.

- Make a note of important dates and details: Once you’ve received your invitation, try not to put it on the fridge and forget about it. You’ll want to make note of the date, time of ceremony and reception, addresses and dress requirements.

- Arrive early: Unless you’re the one walking down the aisle, you’ll want to avoid being fashionably late. Try to arrive 15-20 minutes early to use the bathroom, mingle and find your seat before the ceremony begins to avoid any disruptions.

- Ask how you can help at the end of the night: Whether it’s helping the caterers clean up, transporting gifts, or giving a friend or family member a ride home, look for ways to be of service to your hosts as a “thank you” for including you in their special day.

Tips on navigating wedding season without putting yourself in debt

Start a plan when the ring hits your newsfeed

Couples tend to send out save-the-date cards to guests between six to eight months before the event, but is that the right time to start saving?

With recent studies showing that guests can expect upwards of $1,000 to attend a wedding outside of their hometown, the earlier you start saving, the better. If you can afford to set aside $100 a month for the wedding after you’ve paid your bills and set aside money for your savings goals, that might be plenty of time to prepare.

But if you can’t afford to set aside that much each month or if you’re saving for multiple weddings, you really ought to start planning early. According to wedding planning website The Knot, the average engagement lasts 14 months. If you start planning from the time the first ring selfie hits social media, you could be in a good position to survive wedding season debt-free.

Is it presumptuous to start saving before you’ve been invited or asked to be in the wedding? Maybe, but there is no real downside. Should you get overlooked, you’ll now have some extra dough to spend on yourself.

Figure out where to put savings

Figuring out when to start saving is only part of the equation, of course. You also need a strategy for where to save. Perhaps you’re disciplined enough to let the money for your best friend’s wedding live in your general savings account, but it might be a good idea to keep it separate.

“I’d suggest opening a dedicated savings account for the expenses you plan to incur, and save some of every paycheck there,” says Bankrate’s chief financial analyst Greg McBride, CFA. Indeed, it might be a good opportunity to try out an online bank, which may offer higher interest rates.

Several neobanks and savings apps also allow you to set up specific goals-based pockets in your account for everything from a down payment on a house to a vacation in the Bahamas. Say you’re planning to attend four weddings next summer. You could direct apps like Qapital, Chime or Mint to move $20 into the earmarked pools each month.

Be practical

While going into debt to celebrate someone else’s milestone isn’t ideal, sometimes you might just have to put some of the expenses on your credit card.

“Can you put a price on friendships that last 25 years or more?” McBride asks. “Going into debt for something like a wedding is a personal decision. Of course, these don’t sneak up; you have time to plan. But even if you need to bridge the gap with borrowing, you have to develop a game plan to pay it off quickly.”

Alongside taking on debt, however, you ought to look for ways to save money where you can. Use points to travel, or take advantage of great sign-up points bonuses on cards.

A few additional money-saving tips:

- Shop your closet: Before you shell out a few hundred for a brand new outfit, see if there’s something you already own that’s appropriate for the wedding. If not, ask a friend or family member if they have something in their closet that will suit your needs. That’ll help you save some money that could be put towards the gift or travel costs.

- Coordinate a group gift: See if other guests or family members are willing to split the cost of one of the nicer gifts on the couple’s registry. It’s a win-win for the couple and for other guests looking to cut costs.

- Use the gift registry as inspiration: If all of the affordable gifts on the registry have been snatched up, see if you can find a more affordable gift for the hosts based on what they added to their list. Perhaps they like a certain style of decor for their home or have registered for baking materials. Use that information to purchase a gift they’ll love that won’t burn a hole in your checking account.

- Split lodging and transportation costs: If you’re attending a wedding out of town, see if there’s anyone you know attending the wedding that you’d feel comfortable bunking with overnight or splitting gas or rideshare costs with.

- Know when to say “no”: Saying “no” is always an option, too. That might mean skipping the destination bachelorette party or just not attending. It’s OK to do this, especially when the costs associated with attending a wedding get in the way of your own financial priorities.

The bottom line

Wedding season can be an exciting time full of lifelong memories. However, if you’re not careful, you might find yourself overspending and falling into a debt spiral that can be difficult to recover from. By setting a budget for yourself and looking for savvy ways to trim costs ahead of time, you can avoid a hefty balance spoiling your memories of the big day.

Blog post courtesy of Bank Rate

Written by Robert Barba and Ivana Pino

No comments yet.